What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act, abbreviated as PPACA or ACA (Affordable Care Act), is a healthcare reform carried out by President Barack Obama on March 23, 2010. Though facing substantial controversy and legal challenges, the health law is still observed as the landmark of a regulatory overhaul in health care and the most significant legislation since the passage of Medicare and Medicaid in 1965. With the ambitious reforms on private health insurance, Medicaid expansion, and Medicare enhancements, it has taken nearly four years to implement the major provisions. The following summary discusses PPACA individual mandate, preventive care, and Exchange subsidies including premium tax credit and cost-sharing reductions. Keep reading to learn more about it.

PPACA Individual Mandate

To expand the applicant pool and bring healthcare expenditure down, PPACA requires all US citizens and legal residents to be covered. With healthy people enrolled, the expenses of the high-cost enrollees could be offset and, therefore to reach an overall balance. People without a minimum essential coverage in 2018 or earlier were generally charged a shared responsibility payment of $695 per adult or $347.50 per child unless they were exempted from the shared responsibility provision. However, the individual mandate penalty was repealed by President Trump and there is no tax penalty since 2019 with the exception of a few states including New Jersey, Massachusetts, Vermont, and District of Columbia where the health insurance mandate still exists.

Exchange Subsidies

Health care cost is like a ticking time bomb for Americans who are uninsured or underinsured. Many people, especially those with low-income, often have limited health care access and poor health care quality. To eliminate financial burdens on Americans and provide accessible health insurance, PPACA offers Exchange subsidies of premium tax credit and cost-sharing reductions to people who are eligible.

- PPACA Premium Tax Credit

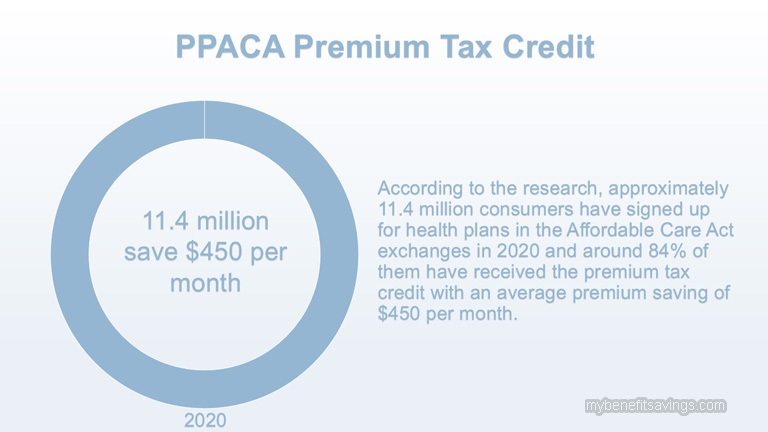

PPACA premium tax credit, abbreviated as PTC, is a refundable tax used to reduce insurance premiums for low-income or middle-income individuals and families when they purchase health coverage through Marketplaces. According to the research, approximately 11.4 million consumers have signed up for health plans in the Affordable Care Act exchanges in 2020 and around 84% of them have received the premium tax credit with an average premium saving of $450 per month. By providing financial assistance, PPACA encourages more people to get enrolled and decreases the number of uninsured.

To qualify for PTC benefits, marketplace enrollees must meet the following requirements:

A) The income threshold for PTC Eligibility

Enrollees should have household incomes between 100%-400% of the 2019 Federal Poverty Level (FPL);

| Figure 1 Income Ranges Applicable to Eligibility for 2020 Premium Tax Credits | |||

| Income Percentage of Federal Poverty | Annual Federal Poverty Level | ||

| Household Size of One | Household Size of Two | Household Size of Four | |

| 100% – 138% | $12,490 – $17,236 | $16,910 –$23,336 | $25,750 – $35,535 |

| 138% – 150% | $17,236 – $18,735 | $23,336 –$25,365 | $35,535 – $38,625 |

| 150% – 200% | $18,735 – $24,980 | $25,365 –$33,820 | $38,625 – $51,500 |

| 200% – 300% | $24,980 – $37,470 | $33,820 –$50,730 | $51,500 – $77,250 |

| 300% – 400% | $37,470 – $49,960 | $50,730–$67,640 | $77,250 – $103,000 |

| Over 400% | More than $49,960 | More than $67,640 | More than $103,000 |

B) No Access to Minimum Essential Coverage

To qualify for the premium tax credit, applicants might not be eligible for any minimum essential coverage such as government-sponsored or state-sponsored insurances, employer-sponsored insurances, or any other insurances offered in the health insurance market. Minimum essential coverage could include but not limited to Medicare, Medicaid, the Children’s Health Insurance Program, Tricare, and Federal Employees Health Benefits Program, etc.

C) File federal income tax returns

People who are eligible for ACA’s premium tax credit could choose metal coverage in Health Exchanges including Bronze plans, Silver plans, Gold plans and, Platinum plans to save on their insurance bills. The second-lowest-cost Silver plan is known as a benchmark plan, which has a close relationship with the premium subsidy. Lawmakers of PPACA set the difference between the premium of the second-least expensive silver plan in your region and the premium you are expected to contribute as a standard to calculate your subsidy amount. In addition, PTC could be only used to offset the premium for essential health benefits. If your insurance plan includes services like acupuncture treatment, dental coverage, or vision benefits, you are required to pay for the portion of the premium yourself. In the same way, tobacco premium, which is a tobacco surcharge imposed on tobacco users is also excluded by PTC.

- PPACA Cost-sharing Reductions

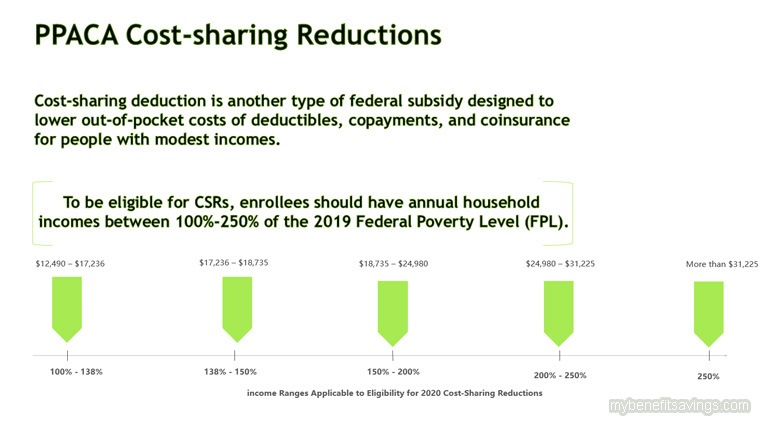

PPACA cost-sharing reductions, abbreviated as CSRs, is another type of federal subsidy designed to lower out-of-pocket costs of deductibles, copayments, and coinsurance for people with modest incomes. Unlike premium tax credit that you could use for any four metal tiers, cost-sharing reductions must be applied to Silver plans sold in the Marketplaces.

A) Eligibility for Cost-sharing Reductions

To be eligible for CSRs, enrollees should have annual household incomes between 100%-250% of the 2019 Federal Poverty Level (FPL). In Medicaid expanded states, CSRS benefits are available for those who have annual household incomes between 138%-250% of 2019 Federal Poverty Level (FPL).

| Figure 2 Income Ranges Applicable to Eligibility for 2020 Cost-Sharing Reductions | |||

| Income Percentage of Federal Poverty | Annual Federal Poverty Level | ||

| Household Size of One | Household Size of Two | Household Size of Four | |

| 100% – 138% | $12,490 – $17,236 | $16,910 –$23,336 | $25,750 – $35,535 |

| 138% – 150% | $17,236 – $18,735 | $23,336 –$25,365 | $35,535 – $38,625 |

| 150% – 200% | $18,735 – $24,980 | $25,365 –$33,820 | $38,625 – $51,500 |

| 200% – 250% | $24,980 – $31,225 | $33,820 –$42,275 | $51,500 –$64,375 |

| Over 250% | More than $31,225 | More than $42,275 | More than $64,375 |

You have to estimate your expected household income for the year you would like to enroll and make sure to include the right people in your household when adding up the total household incomes. Click the below website for a simple assessment of your income level.

https://www.healthcare.gov/lower-costs/

B) How Cost-sharing Reductions Work

By raising the actuarial values of Silver plans and decreasing the maximum out-of-pocket costs, cost-sharing reductions help enrollees with access to affordable and high-quality health coverage.

Increase the actuarial values

Actuarial value enables people to compare and choose health plans offered in Marketplaces more easily. Different metal plans have different actuarial values and generically the higher the actuarial value is, the better the health plans are. The insurance companies pay roughly 60% of medical bills for Bronze plans, 70% of medical bills for Silver plans, 80% of medical bills for Gold plans, and 90% of medical bills for Platinum plans with 2% leeway. However, you should keep in mind that it is an average amount for covered services and it is important to differentiate it from the actual out-of-pocket costs you need to pay during the year.

Cost-sharing reductions increase the actuarial value based on enrollees’ household income. For eligible enrollees who have household incomes between 100% – 150% of FPL, the actuarial value of a Silver plan could be increased to 94%, which is better than a Platinum plan with 90% of actuarial value. You could refer to Figure 3 below for more information.

| Figure 3 Actuarial Value Level Comparison | ||

| Metal Plans | Actuarial Value | Higher Actuarial Values for CSR-eligible enrollees |

| Bronze Plans | 60% with 2% leeway (i.e. 58%-62%) | Not applicable |

| Silver Plans | 70% with 2% leeway (i.e. 68%-72%) | 94% (enrollees with income between 100% to 150% of FPL) |

| 87% (enrollees with income between 150% to 200% of FPL) | ||

| 73% (enrollees with income between 200% to 250% of FPL) | ||

| Gold Plans | 80% with 2% leeway (i.e. 78%-82%) | Not applicable |

| Platinum Plans | 90% with 2% leeway (i.e. 88%-92%) | Not applicable |

Decrease the maximum out-of-pocket costs

By limiting the maximum out-of-pocket cost on covered benefits, CSR subsidies help you lower cost-sharing including deductibles, copayments, and coinsurance for in-network care and services. In 2020, the regular out-of-pocket cap is $8,150 for an individual and $16,300 for a family. But CSR-eligible enrollees who pick a Silver plan could have approximately 20% or 67% reduction, depending on their household income percentage of the federal poverty level:

100-200 percent of the Federal Poverty Level (FPL)

- Your out-of-pocket limit won’t be more than $2,700 for an individual.

- Your out-of-pocket limit won’t be more than $5,400 for a family.

200-250 percent of the Federal Poverty Level (FPL)

- Your out-of-pocket limit won’t be more than $6,500 for an individual.

- Your out-of-pocket limit won’t be more than $13,000 for a family.

PPACA Preventive Care

One of the major provisions of the Affordable Care Act is the requirement for Marketplace health plans to cover recommended preventive services for policyholders and provide a range of preventative care at no additional cost. It has shifted our views of health-related problems from the focus on treatments to early detection and diagnosis. For a long time, the lack of awareness and cost barriers of preventive care stop numerous Americans from obtaining needed preventive services like annual check-ups. However, preventive care is essential to maintain good wellness and health. Comprehensive preventive services could help control risks and prevent illness, reducing the chances of premature deaths. According to the research, 7 out of 10 deaths each year are caused by chronic diseases, among which many could be preventable.

Targeting to different people, there are three types of free preventative services offered to adults, women, and children. And these preventative services could be generally classified into broad categories of evidence-based screenings and counseling, routine immunizations, and preventive care for specific risk groups. The article lists some preventative services for reference purposes and may not be all-inclusive.

| Figure 4 Preventive Care Benefits | ||

| Adults | Women | Children |

| Blood pressure screening | Anemia screening | Autism screening |

| Cholesterol screening | Breastfeeding comprehensive support and counseling | Behavioral assessments |

| Diabetes (Type 2) screening | Contraception | Blood pressure screening |

| HIV screening | Folic acid | Dyslipidemia screening |

| Immunization vaccines | Gestational diabetes screening | Hearing screening |

| Lung cancer screening | Hepatitis B screening | Height, weight, and body mass index (BMI) measurements |

| Obesity screening and counseling | Cervical cancer screening | Hematocrit or hemoglobin screening |

| Hepatitis B screening | Breast cancer mammography screenings | Immunization vaccines |

| Hepatitis C screening | Urinary tract or other infection screening | Oral health risk assessment |

| Tuberculosis screening | Cervical cancer screening | Vision screening |

For a full list, you could check the HealthCare.gov website

https://www.healthcare.gov/coverage/preventive-care-benefits/

Below are other articles that you may be interested in:

Health Insurance Market, Medicaid, and Medicare under the Affordable Care Act

Leave a Reply