The Patient Protection and Affordable Care Act (PPACA), known as Obamacare, has made enormous successes in providing accessible health insurance to Americans and bringing down the rising health care spending. According to the Centers for Disease Control and Prevention (CDC), 48.6 million Americans, which equals 16% of the total population, were without any health care coverage in 2010. Since the enactment and implementation of the PPACA, the number of uninsured people has substantially decreased and the uninsured rate has dropped to a record-low 10% in 2016. To accomplish the health care reforms, the PPACA has contained some major provisions including new private health insurance market rules, Medicare enhancement, and Medicaid expansion. The article discusses Obamacare from the above three aspects and keep reading to learn more about it.

Private Health Insurance Market Reforms

The private health insurance market consists of three segments: the large-group market, small-group market, and individual market. The large-group market provides health insurance coverage through a group health plan maintained by a large employer with an average of at least 101 employees. And small employers with less than 100 employees could offer the Small Business Health Options Program (SHOP) coverage for its employees at a small-group market. Individual market, functioning as a supplemental part, is a remainder market where individuals and families could purchase insurance policies on their own if they are ineligible for government-administered or employer-sponsored health coverage. Different from the large-group market, the small-group market and individual market were less effective and offered few comprehensive coverage and services. By imposing new requirements and regulations, the PPACA aimed to restructure individual and small-group markets, enabling them to fulfill their functions and perform well.

The below summary only demonstrates a part of the federal requirements. Please kindly note that it is not a complete directory of all new rules on the ACA.

-

Essential Health Benefits Package

PPACA requires non-grandfathered health plans in the individual and group markets to include ten essential health benefits (EHB) without limiting annual or lifetime coverage expenses. The set of benefits is considered as a minimum federal standard and states are allowed to expand a broader coverage for more benefits.

The essential health benefits include:

(1) Ambulatory patient services;

(2) Emergency services (e.g. surgery and overnight stays);

(3) Hospitalization;

(4) Maternity and newborn care;

(5) Mental health and substance use disorder services including behavioral health treatment;

(6) Prescription drugs;

(7) Rehabilitative and habilitative services and devices;

(8) Laboratory services;

(9) Preventive and wellness services and chronic disease management; and

(10) Pediatric services, including oral and vision care.

-

Market Rating Reforms

PPACA allows health insurance companies in the individual and small group markets to determine the premium rate of non-grandfathered policies based on Adjusted Community Rating Laws. Under the modified rating methodology, only four factors are allowed to be considered for premium calculation and therefore, insurers could no longer raise premiums for other reasons that are not listed below.

(1)Family structure (individual or family);

(2)Geography;

(3)Age (within a 3:1 ratio for adults);

(4)Tobacco use (within a 1.5:1 ratio);

-

Prohibition of Preexisting Condition Exclusions

PPACA prohibits group health plans in the individual and group markets from excluding coverage for preexisting medical conditions. In other words, if you have a preexisting condition like heart disease, high blood pressure, or diabetes, it is illegal for insurers to charge you a higher premium or deny your coverage. However, there is only one exception that insurers don’t have to cover preexisting conditions if you have a grandfathered individual health insurance policies purchased before March 23, 2010.

-

Prohibition on Discrimination Based on Health Factors

PPACA prohibits group health plans in the individual and group markets from establishing rules for eligibility based on health status-related factors including health status, physical or mental illness, claims experience, receipt of health care, medical history, genetic information, evidence of insurability, disability, etc. By doing so, PPACA has forbidden discrimination and established the federal floor of protections for people who are in poor health.

-

Coverage for Young Adults

PPACA requires health insurance companies to extend dependent child coverage to age 26 regardless of their school enrollment, marital status, residency, financial dependency, or other factors. Young adults under 26 years old are allowed to remain on their parent’s employer plan and enjoy affordable health insurance.

-

Ninety-Day Waiting Period Limitation

PPACA prohibits group health plans in the group markets from imposing a waiting period greater than 90 days. All calendar days including holidays and weekends are counted when calculating the ninety-day waiting period. Employers who fail to comply with the limitation could face excise taxes of $100 per day per employee.

-

Health Insurance Marketplaces

PPACA requires states to establish the American Health Benefits Exchange (AHBE), where individuals and families could compare different health insurance plans and shop for the best healthcare options. Health Benefits Marketplaces have been implemented and operated on the federal and state levels. In 2020, there are 13 state-based marketplaces (SBEs) with their own enrollment websites, 6 state-federal partnership exchanges, 26 federally facilitated exchanges (FFE), and 6 state-based marketplaces using the federal platform (SBM-FP).

Medicaid Expansion

Medicaid is a government-sponsored assistance program that provides health coverage to eligible low-income adults, children, pregnant women, seniors, and individuals with disabilities. As one of the major social welfare programs in the United States, Medicaid help millions of low-income Americans by providing affordable health coverage and constraining out-of-pocket cost. However, since Medicaid has been limited to people in certain categories with very strict eligibility requirements, individuals who are out of the eligibility groups could hardly get insured, which leads to a higher health care cost for all of us and ultimately brings a public health crisis.

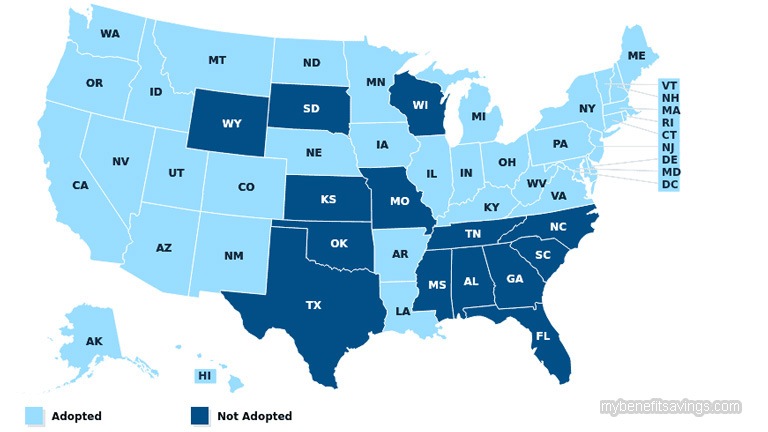

To solve this problem, PPACA has encouraged states to expand the Medicaid program to all Americans whose family income is below a certain income. By providing federal funding support, 36 states and Washington, D.C. have adopted the Medicaid expansion to all people with household incomes at or below 133% of the federal poverty level (FPL). Many states even offer Medicaid coverage to children with a higher income level. Research shows that the federal health care reform has generated substantial coverage gains and dramatically reduced the adult uninsured rate in the Medicaid expansion states.

Moreover, Obamacare has introduced a new methodology called Modified Adjusted Gross Income (MAGI) to simplify Medicaid income-counting rules and make Medicaid income eligibility consistent on a nationwide basis. Prior to the PPACA, each state had its own set of Medicaid income standards for deductions and disregards. But beginning in 2014, states are required to use Internal Revenue Service definitions of MAGI to determine income eligibility for Medicaid. By applying a standard MAGI disregard, which equals 5% of the federal poverty level (FPL), the Affordable Care Act has raised the income level to 138% of the poverty level and made Medicaid more accessible for people to apply and enroll.

The MAGI-based methodology is applicable to most Medicaid groups. It is calculated by adding Adjusted Gross Income (AGI) together with tax-exempt interest income, untaxed foreign income, and non-taxable Social Security benefits. To protect the vulnerable population, certain groups are allowed to be exempt from the MAGI-based income counting rules including but not limited to the followings:

- Individuals who are eligible for Medicaid through another federal or state

- Assistance program

- Seniors age 65 and older

- Certain disabled individuals who qualify for Medicaid on the basis of being blind or disabled, without regard to the individual’s eligibility for SSI

- The medically needy

- Enrollees in a Medicare Savings Program

More information on MAGI-Excepted and Medicaid could be accessed at:

https://www.medicaid.gov/state-resource-center/downloads/magi_screen_presentation-4-26-12.pdf

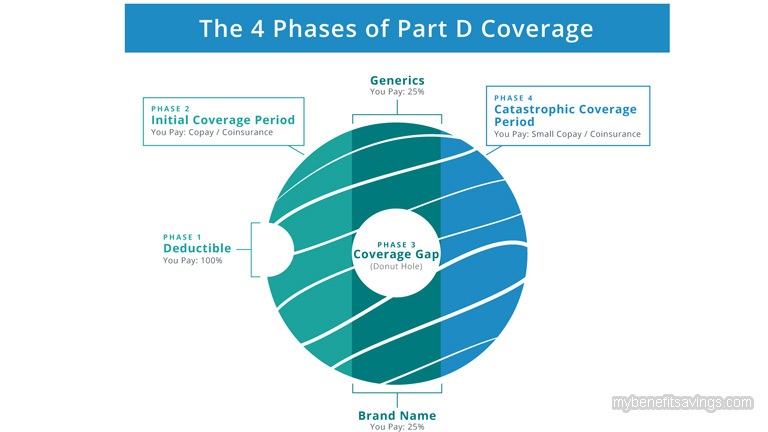

Medicare Enhancements

Medicare is a government-run program that primarily provides health insurance to people who are 65 or older. Young individuals under 65 years old could also qualify for Medicare if they have certain disabilities or End-Stage Renal Disease (ESRD). There are four parts of Medicare including hospital insurance (Part A), medical insurance (Part B), Medicare Advantage (Part C), and prescription drug coverage (Part D). Eligible applicants could choose to cover these different services and receive Medicare benefits from either the Original Medicare Plan or Medicare Advantage Plan (Part C). In 2020, there are 67.7 million people enrolled in Medicare among which 45 million beneficiaries have prescription drug coverage (Part D). Though Part D is an optional coverage, it is a vital component of health care to help people pay for generic and brand-name drugs. According to Centers for Medicare and Medicaid Services (CMS), prescription drug spending grew at an average annual rate of 10.6 percent in Medicare Part D from 2013-2017 and in 2017, total gross spending on prescription drugs in Medicare Part D was $154.9 billion. The skyrocketing price of medications caused a prescription drug coverage gap, which leads to a situation that many Americans still could not afford the priciest drugs even they were enrolled in Part D.

By reducing wasteful healthcare spending and implementing a raft of changes to Medicare, the Affordable Care Act helps lower prescription drug costs and provide better prescription coverage. Prior to the Obama health care reform, people in the “donut hole” were required to pay 100% of drug expenditures out-of-pocket. Beginning in 2011, they could receive an increasing discount on brand-name and generic drugs. See Figure 1 below:

| Figure 1 Drug Discount for People in “Donut Hole” | ||

| Plan Year | Beneficiary Cost-Sharing | |

| Brand-name Drugs | Generic Drugs | |

| 2011 | 50% | 93% |

| 2012 | 50% | 86% |

| 2013 | 47.5% | 79% |

| 2014 | 47.5% | 72% |

| 2015 | 45% | 65% |

| 2016 | 45% | 58% |

| 2017 | 40% | 51% |

| 2018 | 35% | 44% |

| 2019 | 25% | 37% |

| 2020 | 25% | 25% |

The coverage gap had continuously and gradually shrunk. On January 1st, 2020, the “donut hole” gap was completely eliminated and enrollees are responsible for no more than 25% on covered medicines if they reach the coverage gap of $4,020 this year. In addition, beneficiaries could also get out of the coverage gap when spending $6,350 out-of-pocket on prescription drugs during the “donut hole” period and then they would automatically enter the catastrophic coverage phase with a small coinsurance or copay for the remainder of the year.

Below are other articles that you may be interested in:

Medicaid Eligibility and Types

Leave a Reply