What is Social Security and Supplemental Security Income Disability Programs?

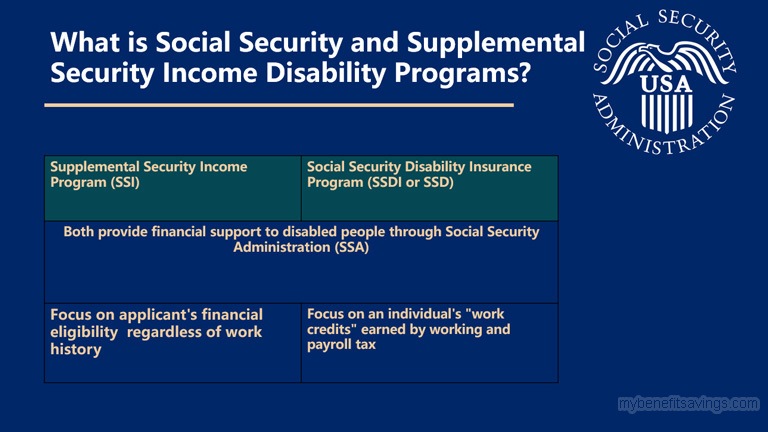

Social Security and Supplemental Security Income Disability Programs are made up of two parts called the Supplemental Security Income (SSI) Program and Social Security Disability Insurance (SSDI, also abbreviated as SSD) Program, which both provide financial support to disabled people through Social Security Administration (SSA). SSI and SSDI vary widely on financial requirements, Medicare & Medicaid health programs, and payment amounts. The biggest difference is that SSDI is more focused on an individual’s “work credits” earned by working and payroll tax while SSI, regardless of work history, pays more attention to the applicant’s financial eligibility. You could receive concurrent benefits of SSI and SSDI at the same time in some circumstances, for example, when you collect very little monthly payment from SSDI. Keep reading this article to find out more details and receive the most entitlement benefits you could get from the two programs.

Who Is Eligible for SSI & SSDI?

Supplemental Security Income (SSI)

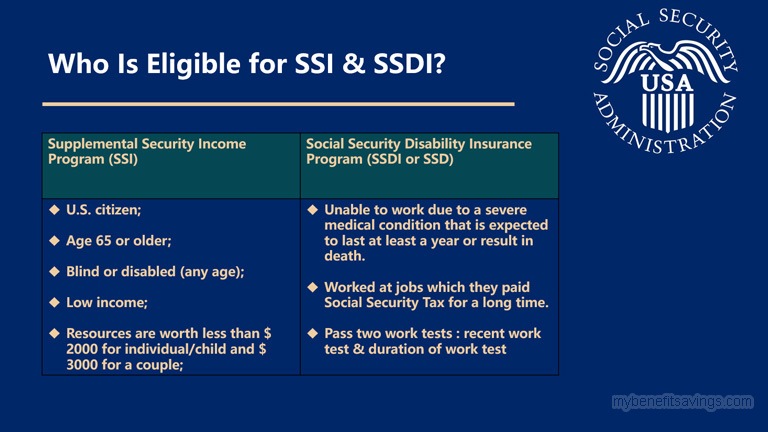

Supplemental Security Income(SSI) is a federal and state patchwork managed by Social Security Administration (SSA) and financed by the general funds of the U.S. Treasury. SSI provides a monthly payment to people who meet the following requirements:

- Age 65 or older;

- Blind or disabled (any age);

- Low income such as wages, social security benefits, unemployment benefits, and worker pensions;

- Resources are worth less than $ 2000 for an individual/child and $ 3000 for a couple, including real estate, bank accounts, cash, stocks, and bonds;

- Must be a U.S. citizen or national, residing in one of the fifty states, District of Columbia, or the Northern Mariana Islands;

In other words, people who are over 65 years old without a disability could still apply for SSI if they meet the income limits but those who are under 65 years old must meet SSA’s definition of disability for SSI eligibility. Additionally, there are some special cases for non-citizens to apply for SSI as well. For more information, you could check https://www.ssa.gov/pubs/EN-05-11051.pdf

Social Security Disability Insurance (SSDI)

Social Security Disability Insurance (SSDI) is an entitlement program run by the Social Security Administration (SSA) and funded by the Social Security Trust Fund. The disability benefits are paid monthly to those who are unable to work due to a severe medical condition that is expected to last at least a year or result in death. To be qualified, the disabled must have worked at jobs which they paid Social Security Tax for a long time. Additionally, disabled workers have to pass two work tests below for SSDI application:

- Recent work test

- Duration of work test

The results of the two tests could reflect your working years and the earnings you have received during your lifetime will be converted to your work credits. In general, 40 credits are needed for disability benefits. In 2020, you could receive one credit for each $1,410 of earnings, up to the maximum of four credits per year.

How to Apply for SSI & SSDI?

Basically, there are three ways to apply for Supplemental Security Income & Social Security Disability Insurance.

- Apply online at socialsecurity.gov

- Apply by phone and make an appointment with a local Social Security Office

- Apply through the third party like an attorney or other qualified person

It is more advisable to file for your SSI or SSDI application in person at a local Social Security office with the help of social security employee. You could have a face to face communication and get better informed of the application process. Social Security staff could offer guidance on your preparation of documentation and forms as well.

What Information Needed for SSI & SSDI?

The documentation you need to apply for disable benefits depends on your personal situation and varies from case by case, but it could be commonly divided into five aspects: identity information, work history, medical records, financial statement, and supplemental materials. The most critical standard Social Security Administration considers when evaluating SSI and SSDI applications is your disability status. Since SSA has its own medical examiners, therefore, you have to well-demonstrate how your physical or mental impairments stop you from doing any substantial gainful activity (SGA) as per the disability definition under SSA. Keep in mind that the documents you provide to support your claims must be accurate and relevant in order to have a quick assessment.

How Long Does It Take to Qualify for SSI & SSDI?

Various factors can affect your application processing time, depending mainly on your individual circumstances. Normally, an initial decision could be received averagely in three and a half months. However, if your disability claim is denied at the first filing, it would take a longer time for reconsideration, disability hearing, and review by Appeals Council or Federal Court. According to a survey, the average duration for SSI and SSDI process involving an appeal is 27 months but most of the cases still remain rejected in the end. For that reason, hiring a lawyer to handle your SSI and SSDI application or represent you at the appeal hearing could be a good choice if you could afford it. Experienced lawyers are familiar with SSA’s rules and could provide legal help, increasing your chances of getting benefits.

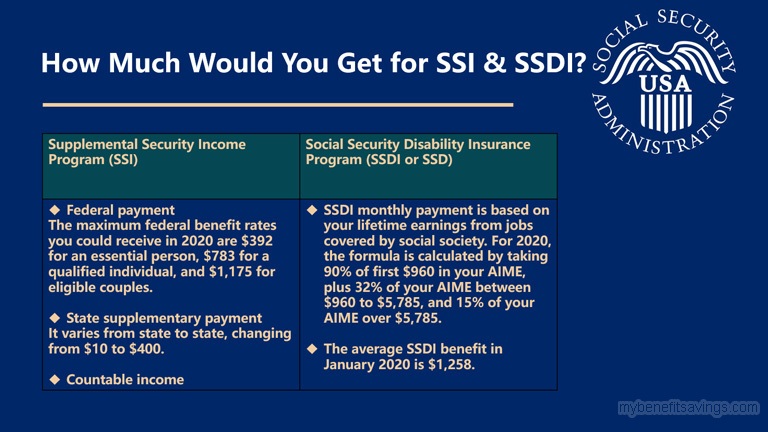

How Much Would You Get for SSDI?

SSDI monthly payment is based on your lifetime earnings from jobs covered by social society and the average SSDI benefit in January 2020 is $1,258. Generally, the more taxes you have paid in the past, the higher the primary insurance amount (PIA) you could receive now. And PIA is calculated in a complicated formula, which changes every year. It is the sum of three separate percentages of portions of average indexed monthly earnings (AIME). For 2020, the formula is calculated by taking 90% of first $960 in your AIME, plus 32% of your AIME between $960 to $5,785, and 15% of your AIME over $5,785. It might sound mathematically overwhelming, but it won’t bother you too much as SSA will calculate it for you.

How Much Would You Get for SSI?

Federal payment, state supplementary payment, and your countable income are mainly three factors influencing your SSI monthly benefits. Federal payment is the same nationwide and the maximum federal benefit rates you could receive in 2020 are $392 for an essential person, $783 for a qualified individual, and $1,175 for eligible couples. State supplementary payment varies from state to state, changing from $10 to $400. Keep in mind that Social Security Administration also reduces your SSI benefit payment by subtracting your monthly countable income, therefore, in most of the cases, you couldn’t get full benefits by just adding your federal and state payments together.

Wonderful! Exactly what Im looking for!

Thanks!

So wonderful!